ebike tax credit california

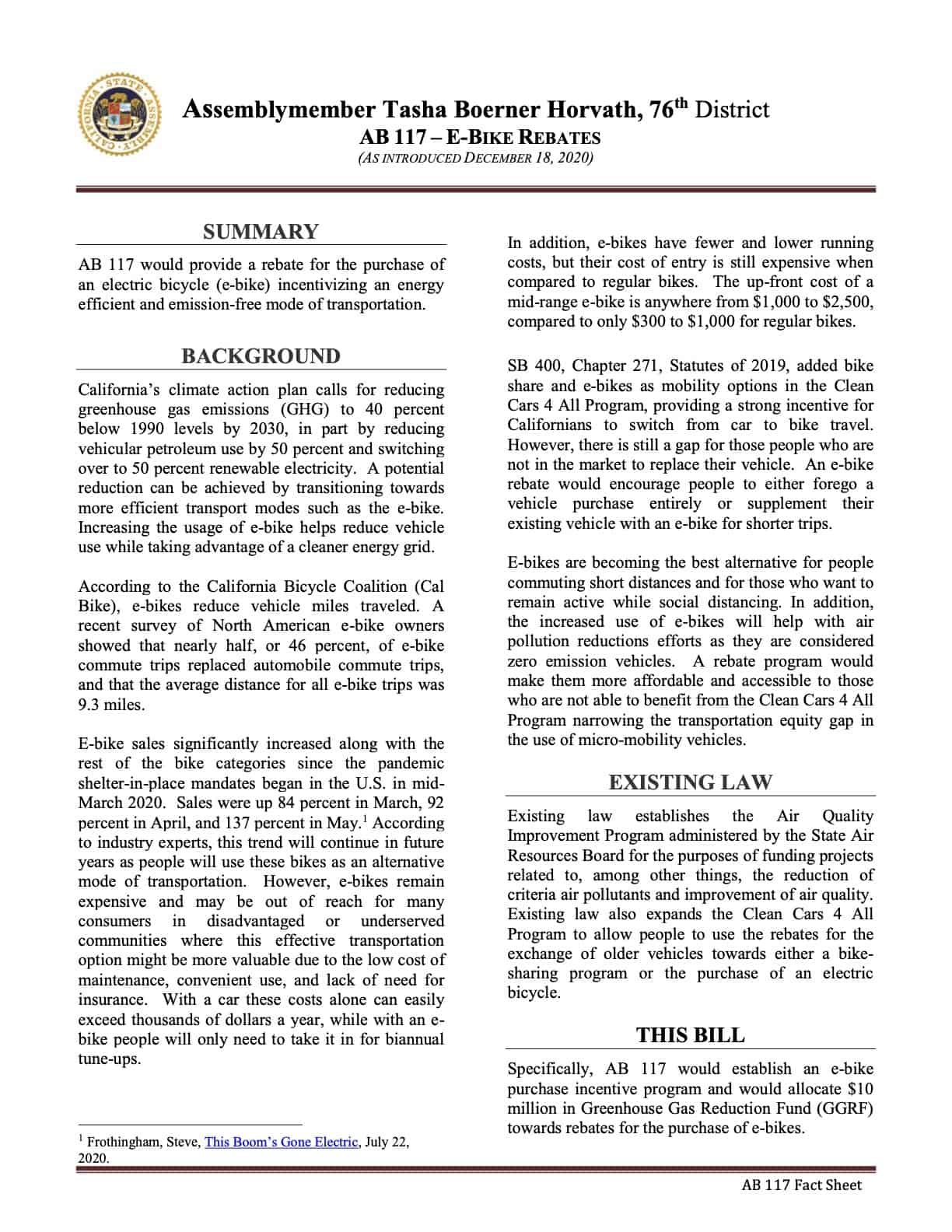

If the E-BIKE Act is eventually signed into law it would offer a 30 tax credit of up to 1500 for buying an electric bicycle. If passed this legislation would provide a tax credit of 30 percent off up to 1500 a new electric bike priced at under 8000.

The credits also phase out according to.

. The tax credit is capped at a maximum of 900 and would only apply to electric bicycles priced under 4000 which includes a wide selection of quality e-bikes but rules out. 1019 by California Representative Jimmy Panetta and is once again gaining momentum thanks to 21 co-sponsors and a companion bill by the same name introduced in. This is an electric bicycle.

The tax credit for your e-bike purchase is a percentage of the purchase price of the electric bike. The credit ranges between 2500 and 7500 depending on the capacity of the battery. The E-BIKE Act is short and simple.

Last year Streetsblog tried to get a clear picture of where the state was on offering e-bike incentives and the answer was. This is not the motorcycle youre looking for. It would provide a federal tax credit of 30 percent of the purchase value of an e-bike available once every three years capped at 1500.

To qualify the electric bicycle would have to be priced. If youre one of the many Americans who end up. A Allowance of creditIn the case of an individual there shall be allowed as a credit against the tax imposed by this subtitle for any taxable year an amount equal to 30.

The program would allow a 30 rebate on purchases of e-bikes that cost up to 8000. As it stands the bill provides a credit of 30 for up to 3000 spent on a new e-bike excluding bikes that cost more than 4000. Grew up in Los Angeles.

The E-BIKE Act is working its way through Congress but if passed consumers could get a tax credit worth up to 1500 on a new e-bike costing less than 8000. Examining e-Bike Rebates in California Benefits of e-bicycling have motivated many cities and countries in Europe to incentivize e-bicycling through a wide variety of intervention programs. The credit begins to phase out for a manufacturer when that manufacturer sells.

California congressman wants to introduce a tax credit for e-bike purchases. Earlier this year the E-BIKE Act proposed a tax credit for e-bikesIn February the US House of Representatives passed a bill proposing a 30 tax credit for the purchase of new. Of course a more realistic and common ebike price of 3000 could mean a tax credit of 900and a 2000 ebike might get you a 600 30 credit.

At that time none of the regional.

E Bikes Out Of Climate Bill The Federal Bill Is Missing The Most Effective Rebate Program

E Bike Rebate Archives Calbike

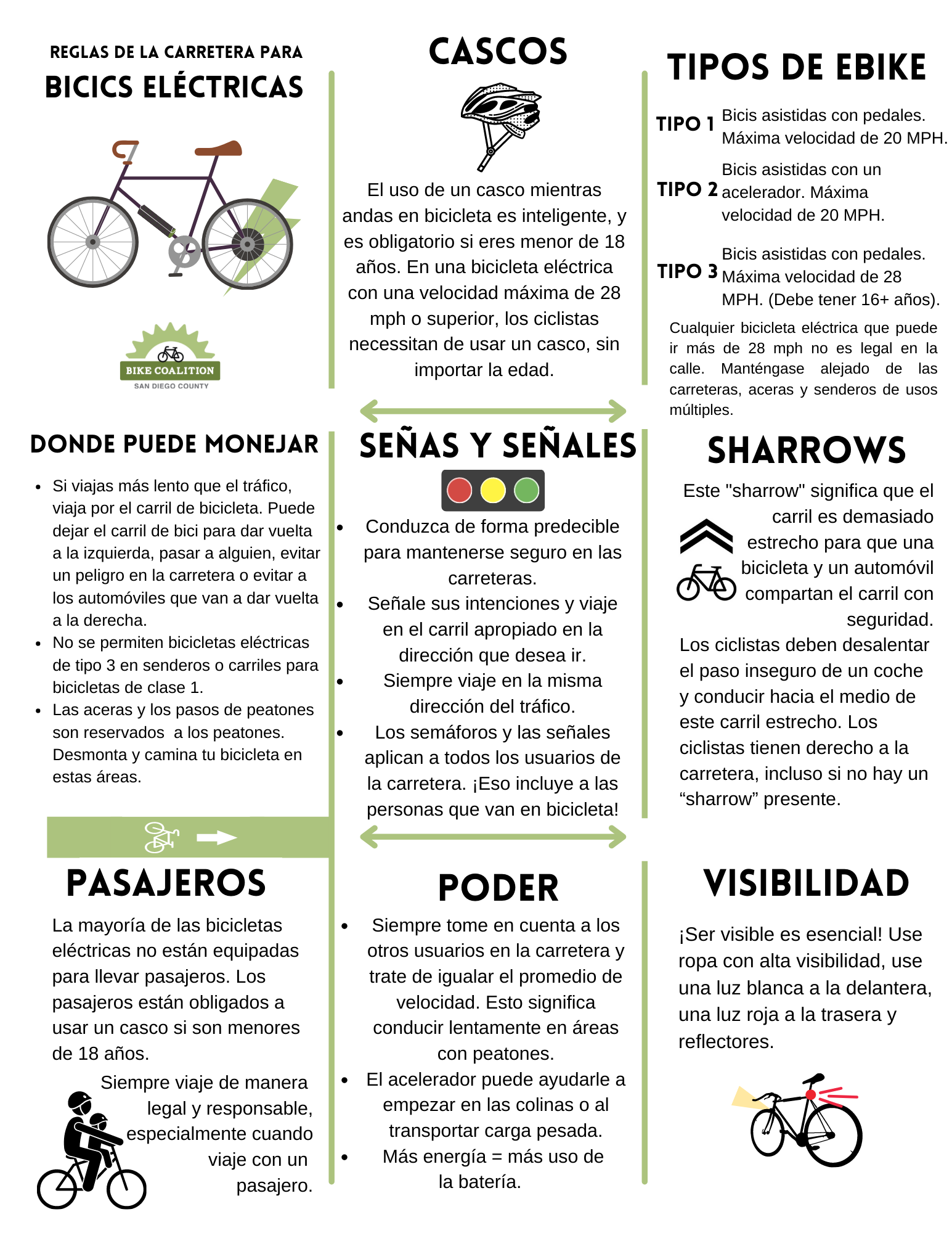

Ebike Classifications And Laws San Diego County Bicycle Coalition

Backed By Business And Advocacy Coalition Blumenauer Introduces E Bike Act Bikeportland

California Commits 10m To E Bike Purchase Assistance Other E Bike Adoption Programs Cleantechnica

Guide To State Local E Bike Rebates And Tax Credits Juiced Bikes

E Bike Act Will Create Vital Tax Credit For E Bikes Calbike

E Bikes For Everyone Peninsula Clean Energy

Amazon Com Jasion Eb7 2 0 Electric Bike For Adults 500w Motor 20mph Max Speed 48v 10ah Removable Battery 20 Fat Tire Foldable Electric Bike With Dual Shock Absorber And Shimano 7 Speed Electric

E Bike Act Could Slash Cost Of E Bikes By 1 500

The Electric Bike Company Redefines The Beach Cruiser With Its Classic Model C Cleantechnica

Op Ed Everything Advocates Need To Know About The Federal E Bike Credit Streetsblog Usa

Electric Bicycle Rebate Program 511 Contra Costa

A 900 Tax Credit For E Bikes Is Part Of Infrastructure Bill Los Angeles Times

California Rebates With E Bicycle Incentive Project Hovsco

4 Ways To Get Financial Help To Buy An E Bike Calbike

Guide To State Local E Bike Rebates And Tax Credits Juiced Bikes

The Popularity Of E Bikes Isn T Slowing Down The New York Times